Will Home Prices Drop in a Recession?

What Happens to the Housing Market During a Recession? Let’s Talk About It.

Every time we start seeing the word “recession” splashed across headlines, it’s normal to feel a little uneasy — especially if you’re thinking about buying or selling a home.

And you’re probably wondering things like:

-

Are home prices going to crash?

-

Will mortgage rates shoot up?

-

Should I wait before I make a move?

These are smart, valid questions. And the truth is, you’re definitely not the only one asking them right now.

But here’s the good news: history gives us some pretty clear answers. So let’s unpack this together.

First Things First: Recession ≠ Housing Crash

Let’s clear up one of the biggest misconceptions right away:

Just because we hear the word recession doesn’t mean we’re heading into a housing crash.

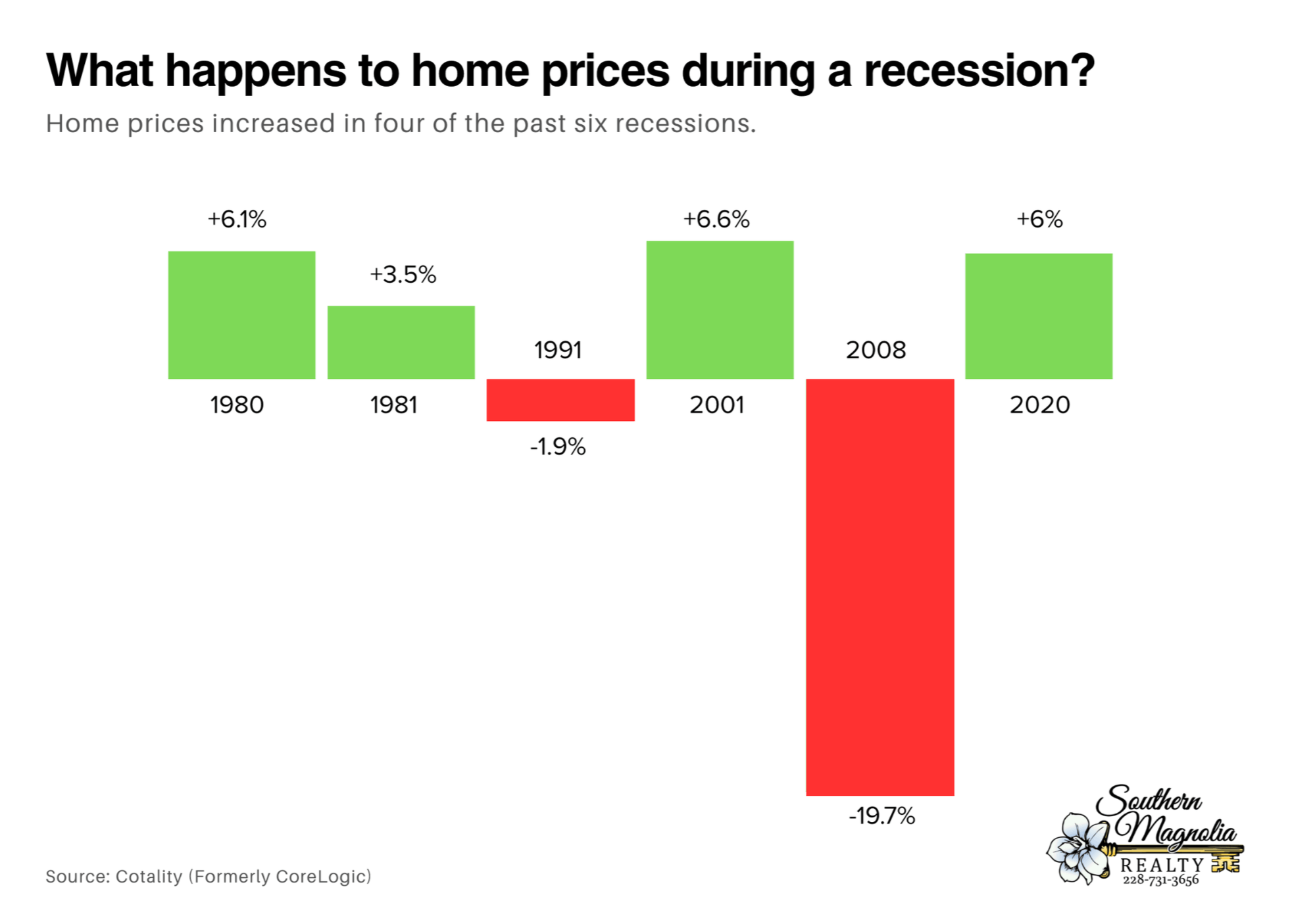

In fact, history shows us that in 4 of the last 6 U.S. recessions, home prices actually went up. And in one of those, prices only dipped less than 2%.

The big outlier? 2008. But remember, that was a completely unique situation — risky lending, overbuilding, and an unstable financial system all collided at once.

So what typically happens in a recession?

-

Home prices usually keep moving steadily or slow their growth a bit.

-

Buyer activity might cool off, but that doesn’t mean prices will fall off a cliff.

-

And — this is important — every local market behaves differently based on supply and demand.

Mortgage Rates? Good News Here Too.

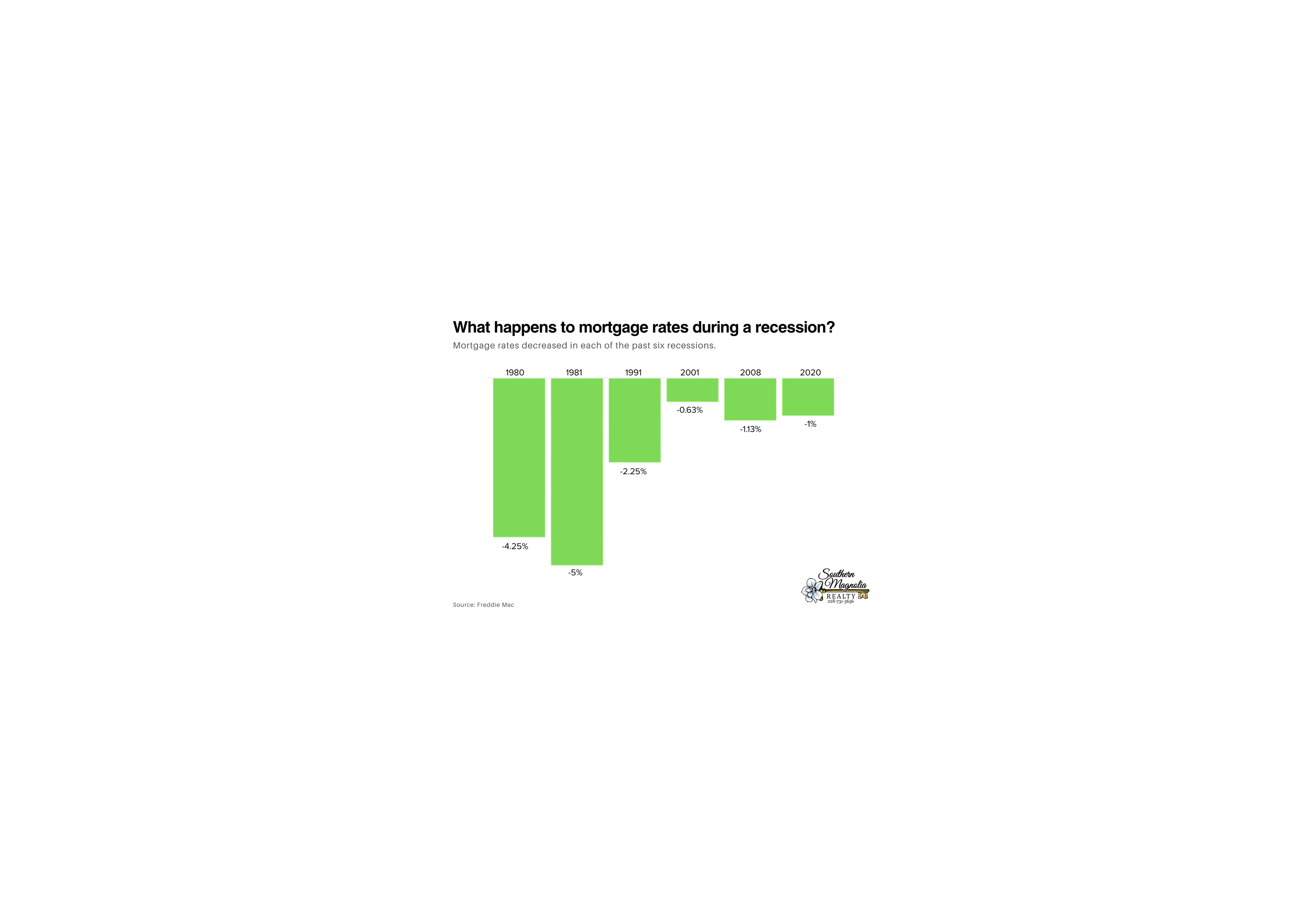

Here’s something most buyers love hearing: mortgage rates usually dip during a recession.

According to Freddie Mac, mortgage rates fell during all six of the last U.S. recessions.

Why?

Because the Federal Reserve typically lowers interest rates to stimulate the economy, and that usually leads to lower borrowing costs.

Now, I’m not saying we’re heading back to those record-low 3% rates from 2020 — but even a small drop in rates can make a meaningful difference in your monthly payment.

Today’s Homeowners Are in a Strong Position

One of the biggest differences between today and 2008 is homeowner equity. Right now, homeowners are sitting on solid equity thanks to steady home price growth over the years.

Realtor.com looked at Federal Reserve data and found:

-

Even if home prices dipped by 10%, homeowners would still have about 69.5% equity — which is around where we were in 2021.

-

A 20% price drop? Equity would still look similar to 2019 levels.

-

Plus, over half of homeowners (54%!) have mortgage rates below 4%, meaning there’s not a lot of pressure to sell.

Bottom line: with that kind of equity cushion, we’re unlikely to see a flood of distressed sales hitting the market, which helps keep prices more stable, even if the economy cools.

Final Thoughts

Look, I know the word recession can stir up fear and uncertainty. But if we let history be our guide, there’s some reassurance:

-

Home prices have mostly held steady or even grown during past recessions.

-

Mortgage rates tend to move lower.

-

And today’s homeowners are in an extremely strong position with high equity and low rates.

If you’re curious about how this all applies to your personal situation, let’s connect. I’d love to help you look past the headlines and make the right move for your future.

Categories

Recent Posts